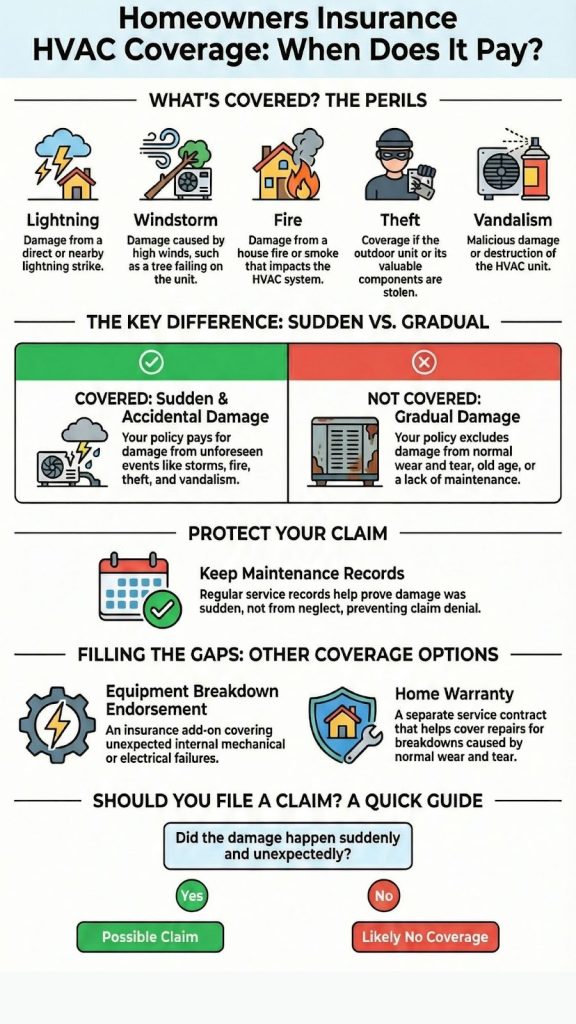

Your homeowners insurance covers your HVAC system, but only under very specific circumstances. It’s not a maintenance contract. The policy responds to sudden, accidental damage from what it calls “covered perils,” like a storm or a fire.

Understanding this line is the single most important thing you can do to protect your investment. Keep reading to learn exactly where that line is drawn and how to make sure you’re on the right side of it.

Key Takeaways

- Coverage is strictly for sudden damage from listed perils, not for gradual breakdowns.

- Proper maintenance records are your best defense against a claim denial.

- Equipment breakdown endorsements and home warranties fill the gaps in standard policies.

Understanding Perils vs. Wear and Tear

| Cause of HVAC Damage | Covered by Homeowners Insurance? | Reason |

| Lightning strike | Yes | Sudden, accidental external event |

| Fire damage | Yes | Listed covered peril |

| Falling tree or debris | Yes | Direct physical damage |

| Theft or vandalism | Yes | Malicious, sudden loss |

| Compressor failure due to age | No | Normal wear and tear |

| Gradual refrigerant leak | No | Maintenance-related issue |

| Dirty coils or clogged filters | No | Neglect and lack of upkeep |

The sound is unmistakable. On a Tuesday afternoon in July, the hum of your central air conditioner sputters, air handler and dies. The house gets quiet, and then it gets hot. Your first thought, after the panic, is about your homeowners insurance.

You pay the premium every year for protection against exactly this kind of financial shock, right? The answer is a firm, “It depends.” And that dependency hinges on a single word insurers use all the time: the peril.

What broke your system? If it was a lightning strike that fried the compressor, you’re probably in luck. If it was the slow, inevitable failure of a 15-year-old unit, you’re almost certainly on your own.

This is the core of HVAC coverage. It’s not about the what,a broken air conditioner,but the why. Insurance companies are in the business of covering accidents, not aging. They protect your home from events, not entropy.

Damage from Storms and Impacts

This is where coverage is most straightforward. If a windstorm sends a tree branch through your outdoor condenser unit, that’s a clear case. Hail can pummel the delicate fins on the unit, rendering it useless.

They might pay the actual cash value, which factors in depreciation, or the full replacement cost if you have that endorsement. It’s a relatively clean claims process when the cause is so obvious.

- Falling objects: A tree limb, a neighbor’s satellite dish.

- Wind and hail: Damaged external units, torn apart ductwork.

- Lightning: Fried circuit boards and compressors.

- Vehicle impact: A car sliding into the condenser.

A lightning strike can surge through the electrical components and destroy the system (1). In these cases, the damage is immediate and traceable to a single, external event. The system was working, then the peril happened, and now it’s not.

This falls under our policy’s dwelling coverage, which protects the physical structure of your home and its permanently installed systems. The insurer will pay to repair or replace the unit, up to your policy’s limit, after we pay your deductible.

Fire, Theft, and Vandalism

Similarly, if a house fire damages your furnace or if thieves strip the copper from your outdoor unit, your policy will respond. Vandalism, like someone deliberately smashing the components, is also a covered peril (2).

These are all sudden, malicious, or accidental acts that cause direct harm. The key here is the immediacy. The system was intact one moment and destroyed the next by a defined event.

It’s worth noting that for theft or vandalism of a window AC unit, coverage would typically fall under your personal property coverage instead of dwelling coverage.

The same peril-based rule applies. The cause of the loss is what matters most.

The Wear and Tear Exclusion

This is the big one. Our air conditioner’s compressor has a finite lifespan, maybe 10 to 15 years. It wears out a little bit every time it cycles on.

The refrigerant lines develop tiny leaks over time. The fan motor bearings slowly degrade. This is normal. It’s expected. And it is explicitly not covered by insurance.

An insurer will likely deny a claim for a system that just stopped working due to age. They view this as a maintenance issue.

You owned the house and the system aged, just as the policy said it would.

This exclusion accounts for a huge percentage of denied HVAC system claims. The system didn’t fail because of a storm; it failed because it was old. The burden of proof is on you to show otherwise, which is nearly impossible without clear evidence of a specific, covered incident.

The Maintenance Clause and Neglect

Policies have clauses that require you to maintain your property. If you can’t prove you’ve taken reasonable care of your capacitor in HVAC system, an insurer can deny a claim even if a covered peril was involved. They might argue that neglect contributed to the damage.

For example, if a power surge damages your system, the insurer might ask about surge protectors. If a claim is filed for a frozen coil that burst, they will want to see records of filter changes and annual tune-ups.

A system choked with dirt and debris is more susceptible to failure. If you haven’t changed the filter in two years, the insurer could claim negligence voided the coverage. Documenting your maintenance is not just good for your system; it’s good for your claim.

The Equipment Breakdown Endorsement

This is an add-on, or rider, you can purchase for your existing homeowners policy. It’s a game-changer for HVAC coverage.

- Equipment breakdown endorsement is an add-on (rider) to your existing homeowners insurance.

- It expands coverage beyond external damage like fire, wind, or hail.

- Covers internal mechanical and electrical failures your standard policy excludes.

It covers things like power surges that bypass surge protectors, boiler pressure explosions, and short circuits. It’s specifically for the sudden, accidental breakdown of home systems and appliances. This endorsement transforms your policy from just covering disasters to also covering major mechanical failures.

The Home Warranty Option

Credits: WCPO 9

A home warranty is a separate service contract, not insurance. You pay an annual premium and a service fee for each repair visit. For a set fee, a contractor will come out, diagnose the problem, and repair or replace the broken component.

Home warranties are ideal for handling the wear-and-tear issues that insurance excludes. A worn-out blower motor, a faulty thermostat, a leaking valve,these are the bread and butter of home warranty claims. They don’t require a “peril.”

- Covers gradual breakdowns that insurance excludes.

- Fixed service fee per repair call.

- Focuses on functionality, not the cause of failure.

While they have their own limitations and waiting periods, they provide a predictable cost for managing the aging systems in your home.

They just require something to be broken.

FAQs

Does homeowners insurance cover my HVAC system?

Yes, homeowners insurance can cover your HVAC system, but only in special cases. It pays when sudden damage happens from things like storms, fire, or lightning.

It does not pay for old parts wearing out or poor care. Insurance helps with accidents, not aging. Knowing this helps you avoid surprise bills and understand when you can file a claim and when you cannot.

Will insurance pay if my AC stops working?

It depends on why it stopped. If your AC breaks because it is old or worn out, insurance will not pay. If it stops because of a sudden event like lightning or a falling tree, it may be covered.

Insurance looks at the cause, not just the broken unit. Always find out what caused the problem before calling your insurer.

What is a covered peril?

A covered peril is a sudden event your insurance lists as protected. Examples include fire, storms, lightning, or vandalism. These events happen quickly and cause clear damage. If a covered peril breaks your HVAC system, insurance may help pay. If the damage happens slowly over time, it is not a covered peril. Reading your policy helps you know which perils count.

Is wear and tear covered by insurance?

No, wear and tear is not covered. HVAC systems wear out as they get older. Parts slowly break down from normal use. Insurance does not pay for this kind of damage. It is seen as a maintenance issue. Planning for repairs or replacements is important. This is why many homeowners use home warranties or savings to handle aging systems.

Why does maintenance matter for claims?

Maintenance shows you took good care of your system. Insurance companies may ask for proof like service records. If you skip filter changes or tune-ups, they may deny a claim. They can say neglect caused the damage.

Keeping receipts and service notes helps protect you. Good care keeps your system running longer and helps your chances if you need to file a claim.

What is an equipment breakdown endorsement?

An equipment breakdown endorsement is extra coverage you can add to your policy. It helps pay when your HVAC breaks from inside problems, like motor failure or power surges. Regular insurance does not cover this. This add-on fills the gap. It costs extra but can save money on big repairs. Ask your agent if this option is right for your home.

How is a home warranty different from insurance?

A home warranty is not insurance. It is a service plan. You pay a yearly fee and a small service cost when something breaks. It covers wear and tear problems. Insurance covers sudden disasters. Home warranties are helpful for old systems. They focus on fixing or replacing parts so your system works again, not on what caused the damage.

Will insurance cover stolen AC parts?

Yes, insurance usually covers theft. If someone steals parts like copper from your AC unit, it is a covered peril. The damage must be sudden and reported. Outdoor units are often covered under dwelling coverage. Window units may be under personal property coverage. Always file a police report and contact your insurer quickly if theft happens.

Does insurance pay full replacement cost?

Not always. Some policies pay actual cash value, which subtracts age and wear. This means you get less money. Other policies include replacement cost coverage, which pays more. Check your policy to see which one you have. Knowing this helps you plan for out-of-pocket costs if your HVAC system needs to be replaced after damage.

How can I make sure I’m protected?

Start by reading your policy carefully. Know what is covered and what is not. Keep up with HVAC maintenance and save records. Ask about equipment breakdown coverage or a home warranty. These steps work together. Being prepared helps you avoid surprises. When you understand your coverage, you can protect your home, your comfort, and your budget.

Making Your Coverage Work For You

Knowledge is your best tool. Don’t wait for a crisis to find out what your policy says. Take an afternoon to actually read your policy declarations page. Look for any sub-limits on air conditioning units. Some policies cap payouts for certain items, so a $15,000 AC replacement might only be covered up to $10,000.

When you know what your insurance covers, the next step is protecting the system itself. A trusted HVAC partner like Centerline Mechanical can help you stay ahead of breakdowns with professional inspections, maintenance, and honest guidance,before a small issue turns into a costly claim.

References

- https://www.researchgate.net/publication/265624055_Indirect_Effects_of_Lightning_Discharges

- https://www.investopedia.com/terms/v/vandalism-and-malicious-mischief-insurance.asp